We have been taught to do savings

since our childhood. Everyone and financial

experts say that “the compounding effect” will make your savings very

considerable, but no one ever

said, “Who is going to pay the terrifying gigantic financial end result of the

compounding effect?” Einstein once said, “The compounding effect is more tragic

than the explosion of an atomic bomb.” We have savings in the bank and

insurance companies that guarantee a minimum rate of return. Once people withdraw large sums when

the deposit matures or when the

insurance policy has expired, where and how these financial institutions come

up with a huge amount of money to pay the principal plus the interest generated

by the compounding effect? (Example: When an interest rate of 7.5% per annual

being compounded for 10 years, $100 will become $206) In reality, the economy is not growing

each year, so how do these financial institutions earn enough principal plus

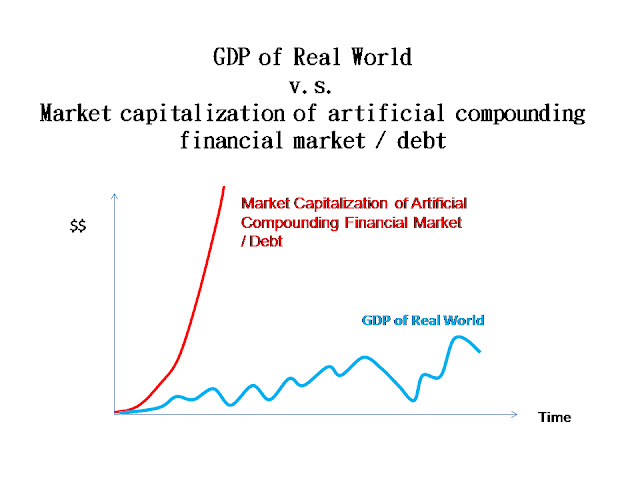

interest from economy and give it back to us? CROSS Capital Group thinks that the ups and downs of the real

economy are common, so no one can catch up the accelerating expansion of the

compounding value of man-made financial market from real production of real

economy. The following statistical chart is a simulation diagram of

"the market capitalization of artificial compounding financial market /

debt" and "GDP output from real economy”.

Consequently, in order for human or

governments to catch up with this unreachable bubble of artificial compounding

financial markets, it will exhaust the resources of the physical world

ignorantly and selfishly, and tries to drive-up the economic GDP output to

satisfy and pay off the man-made compounding effect bubbles. However the ebb of

the economy is common, it cannot be expanded with no limitation as man-made

compounding effect (even a land needs a fallow period to be revived in order to provide again in the future; still less the real economy needs to

rest too), so people will foolishly "create demands" to meet the

supply, plus selfishly plunder the resources of the real word to satisfy

people’s needs and solve their own problems, or to pay off the compounding

effect bubbles. It will only squander the resources of the earth and moving

towards the destruction of human civilization.